Catch Interest Rates If You Can

Interest Rates are at all time lows, but they are poised to rise. What does that mean for Boulder businesses?

With interest rates historically low and unemployment now at 6.7%, everyone is starting to wonder when inflation is going to kick in. While it is true that Janet Yellen and the Federal Open Market Committee (FOMC) recently eliminated the longstanding “Evans Rule” a 6.5% unemployment target for raising interest rates, with 1 and 3 year treasury yields below 1% now since late 2008 it seems logical to assume that the writing is on the wall that interest rates are poised to rise.

When interest rates rise, the cost of all loans including commercial loans and SBA loans will rise. So, what does this mean for Boulder and how is this going to affect Commercial Real Estate locally?

Locally in Boulder, interest rates for owner occupied commercial real estate, often SBA loans, have been 5% on average and 4% for commercial investor loans (Quotes from Wells Fargo 4/14). Multi-family financing is at an all-time low, recent transactions I’ve participated in have interest rates as low as 3.75%! Now, compare this to cap rates or the net return on investment property. Cap rates for the lowest risk profile in Boulder (multi-family units) are as low as 4-5%, higher cap rates in Boulder can be found for an investor with more of a risk tolerance looking for a better return with office space averaging 6-7% and industrial real estate transactions around 7-9%. Comparing the two we see an overlap with the cost of capital being between 4-6% and cap rates for various property types ranging from 4-9%. Not a bad opportunity to borrow the money at say 5% and then use that money to buy a property paying 7% net returns.

The big question out there: If interest rates rise will rents be able to keep up?

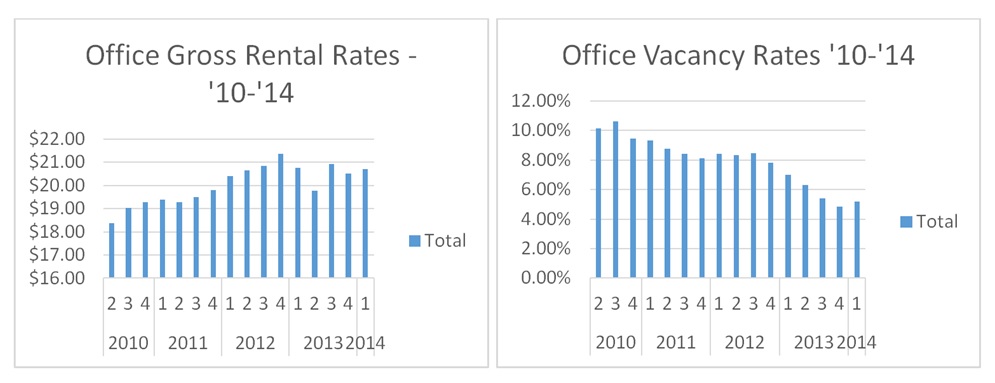

A trend of increasing rents has been in full effect for the last few years with gross office rents across Boulder increasing from an average of $18/SF gross in 2010 to $21/SF gross today an increase of 12%. It should be noted that the highest office rents being paid right now are downtown along the Pearl Street Mall and can be as high as $40/SF gross. In that same period of time from 2010 to the present vacancies have decreased by a half of what they were in 2010 from just over 10% on average across Boulder office space to now just over 5%.

If rents continue to increase at the pace they have for the past few years, the market could accommodate increases in the cost of capital and continue to have that beneficial spread for investors and owner occupants alike. While commercial rental rates have increased substantially over the last few years, my guess is that rents will stabilize across the market over the next 3-5 years. At that time we will have seen a healthy market expansion from high vacancy to low vacancy, low rents to high rents as well as adding upwards of 500K SF of new properties on the market .

While no one can say for sure that interest rates will in fact rise in the future, we can all enjoy the low interest rates as they currently stand. Right now, money is cheap and returns are high. If you have ever thought about buying or selling Commercial Real Estate in Boulder, now just might be that time.