Navigating the Shifting Landscape of Commercial Real Estate in 2024

As we move into the end of 2024, the commercial real estate (CRE) landscape continues to evolve, driven by emerging trends reshaping how we think about office spaces, shopping centers, and population growth. For Boulder and the greater Colorado area, these trends present challenges and opportunities that savvy investors and businesses must consider.

The Return to Office (RTO): A Local Perspective

Based on Placer.ai office building index

Hybrid work is now a standard in many industries, fundamentally altering the demand for office space. Nationally, the return to office (RTO) rates are higher in cities on the East Coast, but what does this mean for Boulder?

While Colorado isn’t leading the RTO rates like some East Coast cities, local data suggest that office visits are increasingly driven by employees living close to their workplace—within three miles, to be exact. For Boulder, a city known for its balance between work and lifestyle, this could mean that office spaces in or near residential areas will continue to have more robust occupancy rates. Businesses that want to attract top talent might consider investing in office spaces that offer a blend of accessibility and the amenities that remote workers crave when they do come into the office.

Shopping Centers: A Resilient Asset Class

One of the most surprising trends in 2024 is the resurgence of shopping centers. Despite the challenges posed by the pandemic, visits to shopping centers have surpassed pre-pandemic levels. Moreover, mall visitors’ income levels have returned to before COVID-19, signaling a normalization in consumer behavior.

This trend is particularly promising for Boulder’s retail real estate market. As consumer confidence returns, shopping centers, mainly open-air and outlet malls, will likely see increased foot traffic. This resurgence makes retail spaces a potentially lucrative investment, especially in areas experiencing population growth.

Data from Placer.ai

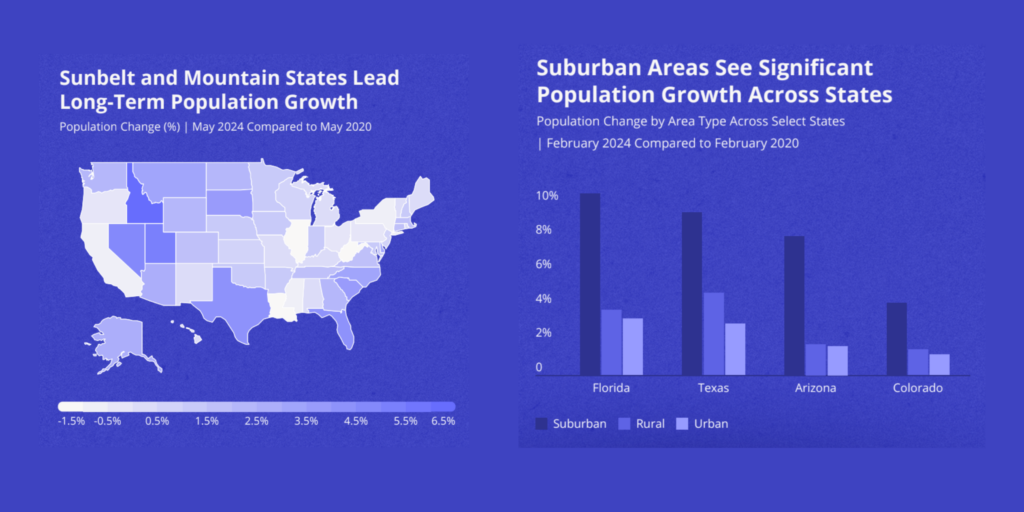

Population Growth: The Suburban Boom

Speaking of population growth, the report highlights a significant trend: suburban areas in states like Colorado are seeing impressive gains. Since 2020, states in the Sunbelt and Mountain regions, including Colorado, have experienced robust population growth, with suburban areas leading the charge.

For investors in Boulder and surrounding areas, this suburban boom means increasing demand for residential and commercial properties outside the urban core. This trend suggests that developments that cater to this growing suburban population—such as mixed-use developments, community-oriented shopping centers, and flexible office spaces—will likely thrive in the coming years.

Data from Placer.ai

Looking Ahead: Opportunities in Boulder’s CRE Market

As we reflect on these emerging trends, it’s clear that Boulder’s commercial real estate market is poised for growth, but the path forward will require strategic thinking and a deep understanding of the local market dynamics. Investors and businesses that can align their strategies with these trends—focusing on well-located office spaces, investing in resilient retail properties, and tapping into suburban growth—will be well-positioned to succeed in 2024 and beyond.

At Market Real Estate, we’re here to help you navigate this shifting landscape. Whether you’re looking to invest in Boulder’s thriving suburban areas, secure the perfect office space, or capitalize on the retail resurgence, our team has the local expertise and industry insight to guide you every step.